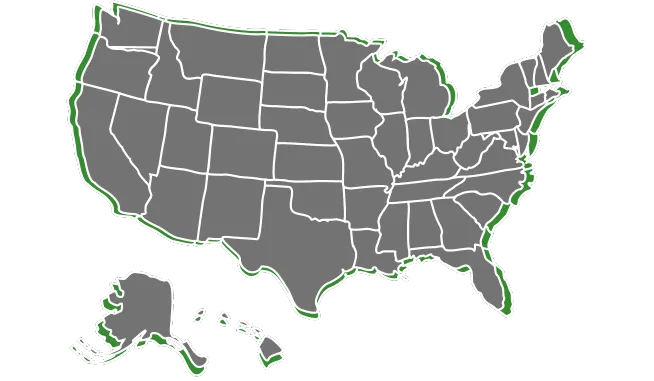

what is your pension grade?

Just 20% of teachers receive a complete pension, while over half of those in the teaching profession never receive any form of pension. Presently, almost 40% of teachers lack coverage under Social Security.

| State | Pension Grade |

|---|---|

| Alaska | C |

| California | C |

| Colorado | D |

| Hawaii | D |

| Idaho | C |

| Montana | D |

| Oregon | D |

| Utah | C |

| Washington | B |

| Nevada | D |

| Wyoming | C |

| State | Pension Grade |

|---|---|

| Illinois | D |

| India | C |

| Iowa | C |

| Kansas | D |

| Michigan | D |

| Minnesota | D |

| Missouri | C |

| Nebraska | B |

| North Dakota | D |

| Ohio | D |

| South Dakoda | B |

| Wisconsin | N/A |

| State | Pension Grade |

|---|---|

| Connecticut | D |

| Delaware | B |

| Maine | C |

| Maryland | C |

| Massachusetts | C |

| New Hampshire | F |

| New Jersey | D |

| New York | B |

| Pennsylvania | F |

| Rhode Island | D |

| Vermont | C |

| State | Pension Grade |

|---|---|

| Alabama | D |

| Arkansas | D |

| Florida | B |

| Georgia | C |

| Kentucky | F |

| Louisiana | D |

| Mississippi | F |

| North Carolina | B |

| South Carolina | D |

| Tennessee | B |

| Virginia | D |

| Washington DC | A |

| West Virginia | C |

| State | Pension Grade |

|---|---|

| Arizona | C |

| New Mexico | C |

| Oklahoma | D |

| Texas | C |

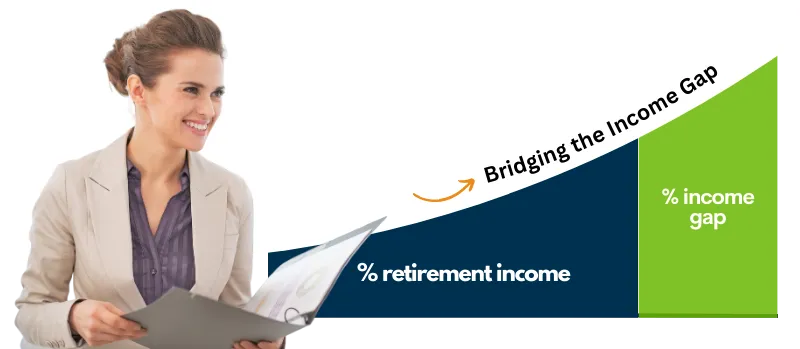

Bridging the Retirement Income Gap for Teachers

What you need for a healthy retirement?

It's important for teachers to seek personalized financial advice from professionals experienced in retirement planning to ensure they are well-prepared and have a clear roadmap for a healthy retirement.

It's important for teachers to seek personalized financial advice from professionals experienced in retirement planning to ensure they are well-prepared and have a clear roadmap for a healthy retirement.

How Much Will You Need To Retire?

What you need for a

healthy retirement?

It's important for teachers to seek personalized financial advice from professionals experienced in retirement planning to ensure they are well-prepared and have a clear roadmap for a healthy retirement .

Despite the reliance of numerous teachers on their state-funded pensions, it is important to recognize that these pensions may provide less than anticipated. On average, states possess adequate funds to cover slightly over 70% of their pension obligations. This deficit has prompted states to make adjustments to their programs in order to diminish future benefits.

The closer you are to retirement, the higher the likelihood that these prospective alterations may impact your benefits. Consequently, understanding your income gap and exploring the potential assistance provided by a 403(b) annuity becomes crucial.

Don't Let These 3 Social Security Surprises Ruin Your Retirement, The Motley Fool, July 9, 2021

Every State's Pension Crisis Ranked, 24/7 Wall Street, December 4, 2020

Retirement Needs Assessment Tool

In a world filled with uncertainties, it is crucial to start contemplating intelligent strategies for saving towards your retirement. This tool will guide you through a set of brief questions regarding your retirement objectives, enabling you to assess your readiness for the future. Embark on your journey to explore your retirement preparedness today.

Retirement Needs Assessment Tool

In a world filled with uncertainties, it is crucial to start contemplating intelligent strategies for saving towards your retirement. This tool will guide you through a set of brief questions regarding your retirement objectives, enabling you to assess your readiness for the future. Embark on your journey to explore your retirement preparedness today.

What could your retirement income gap look like?

Select a profile to discover how much of an income gap is expected for teachers like you.

These scenarios employ hypothetical salaries and wage increases, as the wages of public school employees vary based on their positions and geographical locations. State pension payments mentioned here are also hypothetical, as actual state pension benefits are contingent upon factors such as the state of employment, age at retirement, and duration of service within the system.

For current teacher salary statistics, visit The U.S. Education Department’s National Center for Education Statistics and National Education Association.

What could your retirement income gap look like?

Select a profile to discover how much of an income gap is expected for teachers like you.

These scenarios employ hypothetical salaries and wage increases, as the wages of public school employees vary based on their positions and geographical locations. State pension payments mentioned here are also hypothetical, as actual state pension benefits are contingent upon factors such as the state of employment, age at retirement, and duration of service within the system.

For current teacher salary statistics, visit The U.S. Education Department’s National Center for Education Statistics and National Education Association.

This new chapter will bring you endless happiness and the fulfillment you so richly deserve.

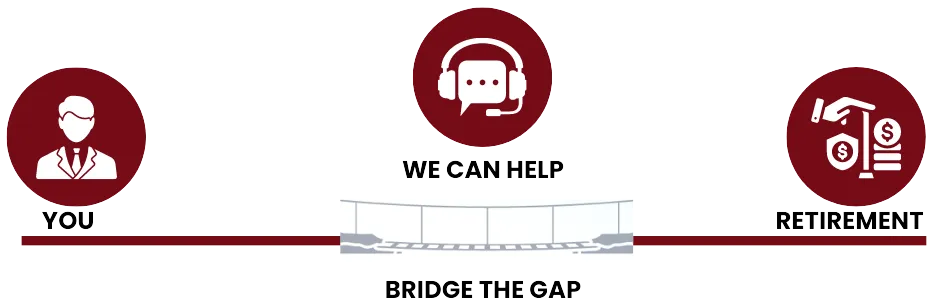

Bridge the Gap

Realizing the presence of an income gap should not dash your retirement aspirations. Fortunately, a retirement savings plan, such as a 403(b) offered by your school system, empowers you to set aside a portion of each paycheck, enabling your savings to grow on a tax-deferred basis. This presents an excellent opportunity to bridge the gap and enhance the stability of your financial future.

Whether you are looking to better understand your options or get free advice from one of our financial professionals, we can help you find the answers you need to take the next step.

Educate Yourself, Empower Your Future

When you take the reins of your own learning journey, a remarkable transformation occurs. By educating yourself, you open doors to endless possibilities, and pave the way for a future that is empowered and enriched.

Will I have enough for retirement?

When can I retire?

Am I putting too much or too little away for my retirement?

What are the fees that I am paying?

Do I have most updated strategy that fits me now?

Educate Yourself,

Empower Your Future

When you take the reins of your own learning journey, a remarkable transformation occurs. By educating yourself, you open doors to endless possibilities, and pave the way for a future that is empowered and enriched.

Will I have enough for retirement?

When can I retire?

Am I putting too much or too little away for my retirement?

What are the fees that I am paying?

Do I have most updated strategy that fits me now?

Let’s create your

retirement lesson plan

Ready to get started? Meet with one of our local agents for a complimentary session to start planning your secure financial future.

GETTING YOU TO YOUR GOALS

Objective:

Achieve the retirement of your dreams.

Purpose:

Meet with a financial professional and create a personalized lesson plan to achieve your goals.

Collaborative Tasks:

Set up an appointment with your financial professional

- Don’t have one? Talk to us and we can help you find one.

Gather these important documents for your meeting:

- Download Salary Reduction Agreement Form (SRA)

- Paycheck stub

- Any prior statements

Learn about your options

Calculate your Retirement Income Gap

Prepare answers to these questions:

- What is the gross amount* of your paycheck?

- How many paychecks do you receive per year?

- What date was your first teaching job?

- How many years (if any) have you taken off from teaching since that first job?

- What is your date of birth?

- What age do you wish to retire?

- What is your existing 403(b) balance (if any)?

Let’s create your

retirement lesson plan

Ready to get started? Meet with one of our local agents for a complimentary session to start planning your secure financial future.

GETTING YOU TO YOUR GOALS

Objective:

Achieve the retirement of your dreams.

Purpose:

Meet with a financial professional and create a personalized lesson plan to achieve your goals.

Collaborative Tasks:

Set up an appointment with your financial professional

- Don’t have one? Talk to us and we can help you find one.

Gather these important documents for your meeting:

- Download Salary Reduction Agreement Form (SRA)

- Paycheck stub

- Any prior statements

Learn about your options

Calculate your Retirement Income Gap

Prepare answers to these questions:

- What is the gross amount* of your paycheck?

- How many paychecks do you receive per year?

- What date was your first teaching job?

- How many years (if any) have you taken off from teaching since that first job?

- What is your year of birth?

- What age do you wish to retire?

- What is your existing 403(b) balance (if any)?

Call (888) 375-4074

Email: [email protected]